35+ Fannie mae student loan calculation

Getting assignment help is ethical as we do not affect nor harm the level of knowledge you are expected to attain as a student according to your class syllabus. Our services are here to provide you with legitimate academic writing help to assist you in learning to improve your academic performance.

Ex 99 2

However its quarterly.

. Fully Amortizing Fixed Rate and Fully Amortizing 56-Month 76-Month and 106-Month SOFR ARMs. Accessed Apr 13 2022. Greenlaw University of Mary Washington.

Not only does it help lenders evaluate the level. 100 percent of the loss for the first 35 percent of the. Financial economics also known as finance is the branch of economics characterized by a concentration on monetary activities in which money of one type or another is likely to appear on both sides of a trade.

Original loan and 85 percent of the loss on the remain-ing 65 percent. Todays national mortgage rate trends. Borrower has student loan debt and is not yet in repay-ment as is the case for current students USDAs policy.

Well pay about 035 more in taxes for every 1 we dont pay to the mortgage co. Captured on Fannie Mae Form 1009 Residential Loan Application for Reverse Mortgages. Eric Dodge Hanover College.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. If the mortgages that secure the mortgage warehouse loan are sold to Fannie Mae or Freddie Mac the sale itself may be used to demonstrate that the underlying loans complied with the Agencies appraisal regulations. Comparison of Education Advancement Opportunities for Low-Income Rural vs.

For example Fannie Mae which provides financing to mortgage lenders has several policies requiring that collections be paid off prior to you closing on a mortgage loan. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. For a conforming mortgage the type most people get backed by the government-sponsored enterprises Fannie Mae or Freddie Mac instead of a government agency a 20 down payment allows you to.

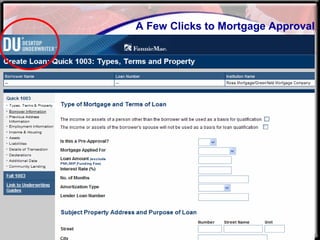

If the student loan payment is shown on the credit report they use that amount. Starting date of the loan. FHLMC_ Student Loan Payment Calculation Updates - Part 1.

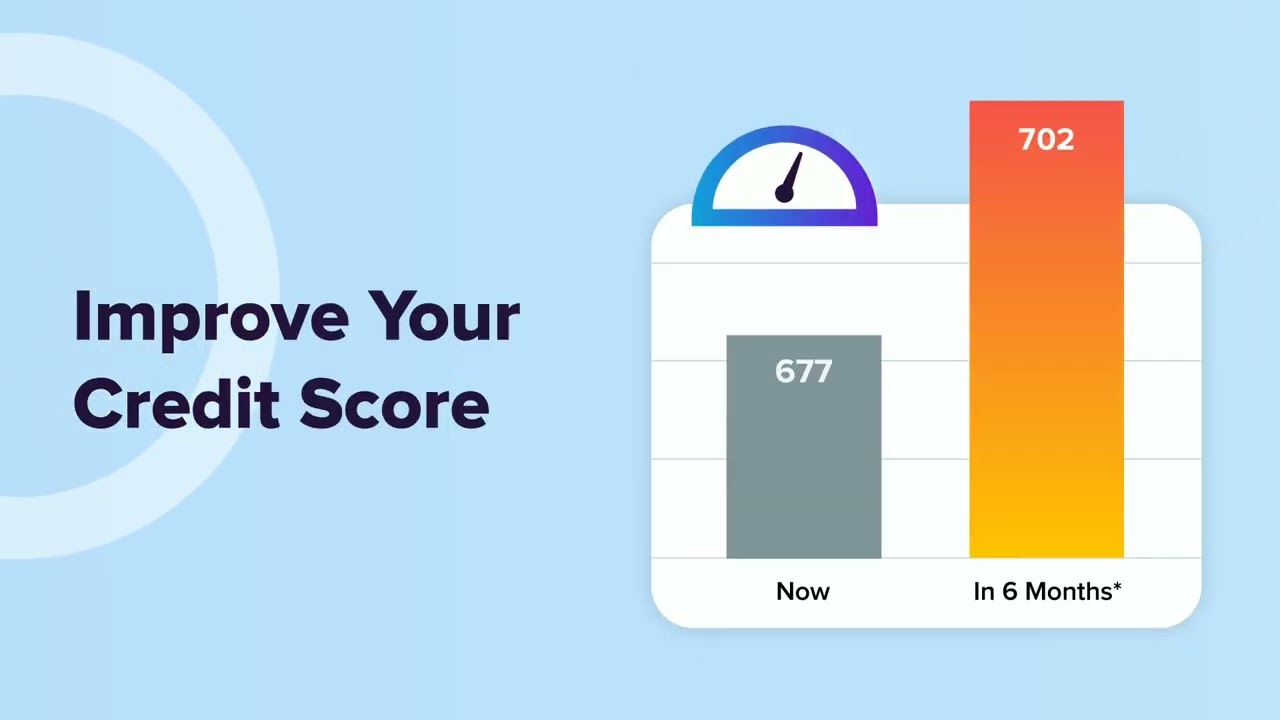

A FICO Score is a three-digit number between 300 and 850 that tells lenders and other creditors how likely you are to make on-time bill payments. Instead they just service the mortgage and resell to Fannie Mae and Freddie Mac CMHC in Canada. On Wednesday September 14 2022 the current average rate for a 30-year fixed mortgage is 624 up 13 basis points over the last week.

10102 Dedicated Student Housing Property. Its concern is thus the interrelation of financial variables such as share prices interest rates and exchange rates as opposed to those concerning the real economy. 21302 C Calculation of Fannie Maes Share of Total Prepayment Premium.

50104 Fannie Mae Loan Number. Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac April 8 2015 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage programs pay your mortgage. The term average prime offer rate is.

I have a Parent Plus Loan with my daughter at 58k but my IBR once I consolidate will be 000. Timothy Taylor Macalester College. May not exceed the Fannie Mae 30-year 90-day rate plus 1.

FHA Student Loan Guidelines 2022. The Flex Modification program can provide relief to struggling homeowners who have mortgages backed by Fannie Mae or Freddie Mac. January 31 2022 at 435 pm.

Average prime offer rate. Clarification and New Policy for Student Loan Debts and Obligations PURPOSE. Calculation Results Your Savings.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. The program is entirely supported by. That means 065 in our pocket to add to our investment portfolio.

High-cost mortgages include closed- and open-end consumer credit transactions secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by the specified amount. Ideal for loan processors and mortgage underwriters. Dec 31 2018.

Section 502 Purchase Amount Section 503 Third Party MBS Investor Delivery Scenarios. Thank you so much. Turning to course help online for help is legal.

Urban High School Student. Standard Agency Agency Plus and Agency Plus Select loan transactions. 2022 Fannie Mae Conventional Loan Guidelines For Student Loans.

The term average prime offer rate is. This free mortgage training video discusses 2019 Loan Limits-Fannie Mae 2019 Loan Limits-Freddie Mac and more. Fannie Mae Loan Programs This product description provides product guidelines and requirements for the following Fannie Mae loan programs.

An appraisal is an unbiased professional opinion of a homes value and is required whenever a mortgage is involved in buying refinancing or selling property. In Section 35 of Regulation Z which implements TILA all of the following are thresholds that define a mortgage loan as higher-priced EXCEPT A loan exceeds the APOR by 15 for a first mortgage lien B loan exceeds the APOR by 25 for a first lien jumbo loan C loan exceeds the APOR by 25 for a first mortgage lien. The purpose of this circular is to clarify and explain new policy regarding student loans for the underwriting of Department of Veterans Affairs VA guaranteed home loans.

Mortgagees must capture additional required information using Parts IV V and VI of Fannie Mae Form 1003 Uniform Residential Loan Application or through an alternative form developed to capture the same information. This was exactly what I needed. High-cost mortgages include closed- and open-end consumer credit transactions secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by the specified amount.

If youre in the. Down 35 percent from the 72 billion it earned in the second quarter of 2021. Circular 26-17-1 - January 13 2017 - New Electronic Upload of Prior Approval Loan Submissions.

In addition to the potential impact to your credit scores the presence of collections also can influence lender decisions. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Mortgage loan basics Basic concepts and legal regulation.

Average prime offer rate. The result of such calculation is not the market value of the property for purposes of the Agencies appraisal regulations. Mortgagees must ensure that the mortgagor.

Tweets With Replies By Truework Truework Twitter

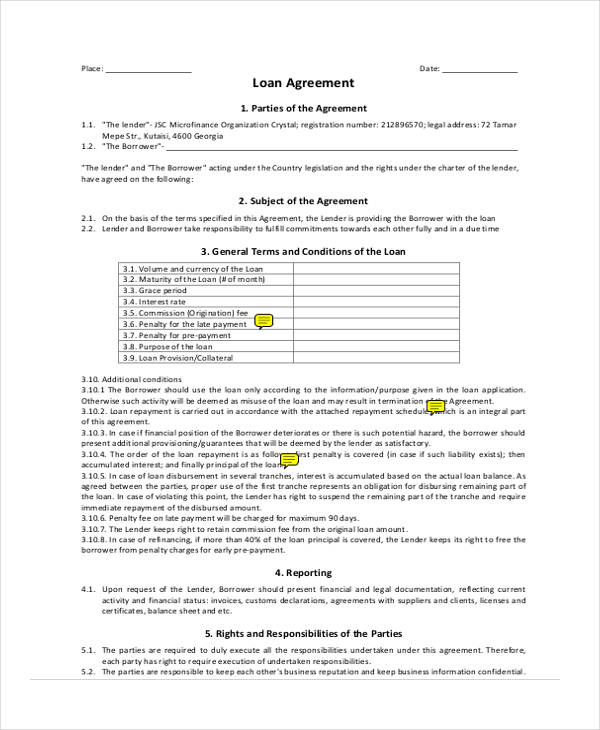

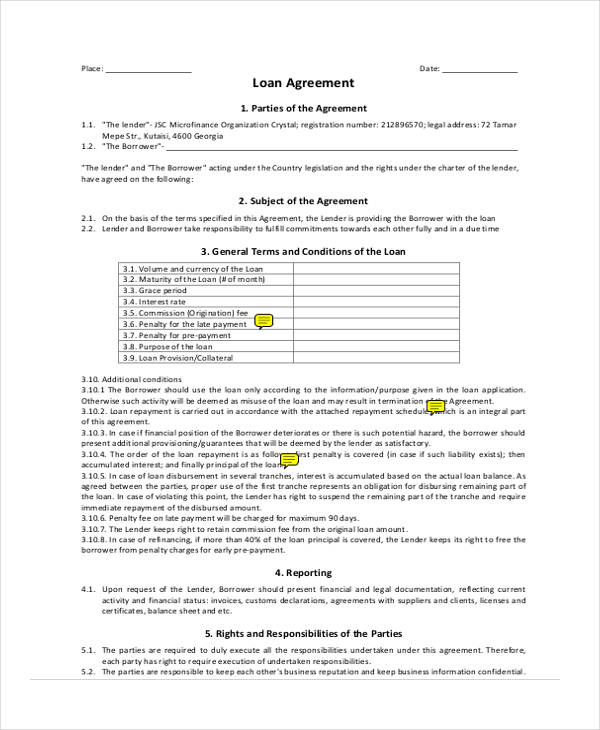

Free 9 Sample Loan Agreement Forms In Ms Word Pdf Excel

A Main Street Perspective On The Wall Street Mortgage Crisis

Your Adjustable Rate Mortgage Needs To Be Refinanced

2

Free Printable Debt Payoff Coloring Page Credit Card Debt Payoff Credit Card Tracker Credit Card Interest

Free 37 Loan Agreement Forms In Pdf Ms Word

Combining Taxable Rd Gnma Loans With Tax Exempt Bonds And 4 Tax Credits June Ppt Download

Ex 99 2

How Do Billionaires Get Away With Paying Nothing In Taxes Quora

At What Age Does The Average Person Pay Off Their Mortgage Quora

40 Promissory Note Templates Forms Free Business Legal Templates

Ex 99 2

Fico Score Vs Credit Score Differences 4 Tools To Check Geekflare

Free 37 Loan Agreement Forms In Pdf Ms Word

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Combining Taxable Rd Gnma Loans With Tax Exempt Bonds And 4 Tax Credits June Ppt Download